Managing personal finances can be a challenge, but with the right budgeting app, you can easily take control of your spending, saving, and overall financial health. Here’s a curated list of the 10 best budgeting apps tailored for U.S. users in 2024, featuring innovative tools and features to make managing money simpler.

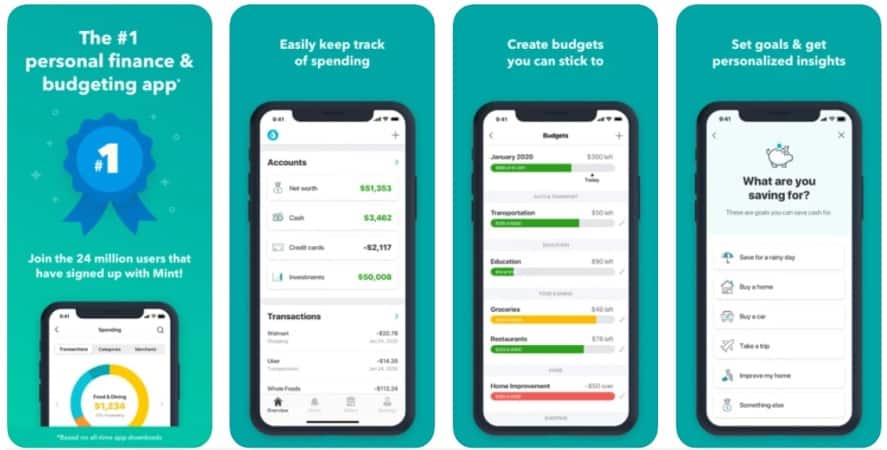

1. Mint

Why It Stands Out: Mint remains a household name in budgeting, offering comprehensive tools for tracking expenses, setting financial goals, and monitoring credit scores.

- Key Features:

- Automatic categorization of transactions.

- Bill reminders to avoid late payments.

- Free credit score monitoring.

- Customizable budgets based on spending patterns.

Best For: Beginners and those seeking a free, all-in-one solution.

2. YNAB (You Need A Budget)

Why It Stands Out: YNAB is perfect for users serious about proactive budgeting, focusing on assigning every dollar a job.

- Key Features:

- Zero-based budgeting methodology.

- Syncs with bank accounts in real time.

- Goal tracking and detailed reporting.

- Extensive educational resources and workshops.

Best For: Users who want to get out of debt and build savings.

3. EveryDollar

Why It Stands Out: Developed by Dave Ramsey’s team, EveryDollar helps you implement a zero-based budget effortlessly.

- Key Features:

- Intuitive, drag-and-drop budgeting interface.

- Syncs with bank accounts (premium version).

- Focused on debt reduction and financial planning.

- Compatible with Ramsey+ for added tools.

Best For: Fans of the Ramsey financial philosophy.

Also read – The Ultimate Guide to Budgeting Apps: Take Control of Your Finances

4. PocketGuard

Why It Stands Out: PocketGuard focuses on showing how much “you can spend” after accounting for bills, goals, and necessities.

- Key Features:

- Real-time tracking of income and expenses.

- “In My Pocket” feature for discretionary spending.

- Easy bill tracking and spending caps.

- Smart algorithms for expense optimization.

Best For: Users who want quick insights into disposable income.

5. Goodbudget

Why It Stands Out: Based on the envelope budgeting system, Goodbudget is excellent for couples and families sharing financial goals.

- Key Features:

- Digital envelope system for budgeting.

- Syncs across multiple devices.

- Manual expense tracking to encourage mindful spending.

- Detailed reports and spending breakdowns.

Best For: Couples and those who prefer hands-on budgeting.

6. Personal Capital

Why It Stands Out: Personal Capital combines budgeting with investment tracking, offering a holistic view of your finances.

- Key Features:

- Free financial dashboard for tracking net worth.

- Retirement planning tools.

- Detailed investment performance analysis.

- Fee analyzer to reduce hidden costs.

Best For: Users looking to manage both budgets and investments.

7. Simplifi by Quicken

Why It Stands Out: Simplifi’s modern, user-friendly interface makes tracking finances effortless.

- Key Features:

- Real-time spending tracking.

- Customizable financial insights.

- Easy-to-set savings goals.

- Subscription-based model with no ads.

Best For: Users who value simplicity and aesthetics.

8. Honeydue

Why It Stands Out: Honeydue is a budgeting app designed specifically for couples, making joint financial planning seamless.

- Key Features:

- Syncs multiple bank accounts.

- Tracks shared expenses and individual spending.

- Bill reminders and alerts.

- Chat feature for communication about finances.

Best For: Couples managing finances together.

9. Zeta

Why It Stands Out: Another great option for couples, Zeta provides tools for tracking shared and individual expenses.

- Key Features:

- Shared and individual financial tracking.

- Bill splitting and joint financial goals.

- Budgeting tools for shared accounts.

- Free to use with no ads.

Best For: Couples and households sharing expenses.

10. Rocket Money (formerly Truebill)

Why It Stands Out: Rocket Money helps users optimize budgets by tracking subscriptions and canceling unused ones.

- Key Features:

- Identifies and manages subscriptions.

- Automatic bill negotiation services.

- Budgeting tools for income and expenses.

- Savings recommendations.

Best For: Users looking to cut down unnecessary expenses.

Expert Advice for Choosing a Budgeting App

- Assess Your Needs: Are you looking for basic expense tracking or a robust tool with investment options?

- Test Free Versions: Many apps offer free versions or trials—explore these before committing.

- Focus on Security: Ensure the app uses encryption and other security measures to protect your data.

- Look for Automation: Automatic syncing with bank accounts can save time and reduce errors.

Final Thoughts

Budgeting apps can transform your financial habits, making it easier to manage money and reach financial goals. Whether you’re tackling debt, saving for the future, or just trying to understand your spending patterns, there’s an app on this list for you. Try a few to see which fits your lifestyle best, and take control of your finances in 2024.

Sources:

- Mint Official Website

- YNAB Official Website

- EveryDollar Official Website

- Personal Capital Official Website

- Rocket Money Official Website