Travel insurance is a must-have for U.S. travelers looking to safeguard their trips against unforeseen events such as cancellations, medical emergencies, or lost luggage. With numerous providers offering a variety of plans, choosing the right one can be overwhelming. To help, we’ve compiled a list of the best travel insurance plans for U.S. travelers in 2024.

1. Allianz Travel Insurance

Why It Stands Out: Allianz offers comprehensive coverage and is a trusted name in the travel insurance industry. Their plans include trip cancellation, interruption coverage, and emergency medical protection.

- Key Features:

- Coverage for trip cancellation/interruption.

- Emergency medical expenses up to $50,000.

- Coverage for lost or delayed baggage.

- Annual plan options for frequent travelers.

Best For: Frequent travelers and those seeking customizable coverage.

2. Travel Guard by AIG

Why It Stands Out: Known for its flexibility, Travel Guard allows you to choose from three levels of coverage: Essential, Preferred, and Deluxe.

- Key Features:

- 24/7 assistance services.

- Medical coverage up to $100,000 (Deluxe plan).

- Add-ons for adventure sports and rental car damage.

- Optional Cancel for Any Reason (CFAR) coverage.

Best For: Travelers seeking tailored coverage options.

Also read – Travel Insurance: Your Comprehensive Guide

3. World Nomads

Why It Stands Out: Popular among adventure travelers, World Nomads offers coverage for high-risk activities like skiing, scuba diving, and hiking.

- Key Features:

- Emergency medical coverage up to $100,000.

- Coverage for over 200 adventure activities.

- Flexible policies for long-term travelers.

- Easy online claims process.

Best For: Adventure enthusiasts and long-term travelers.

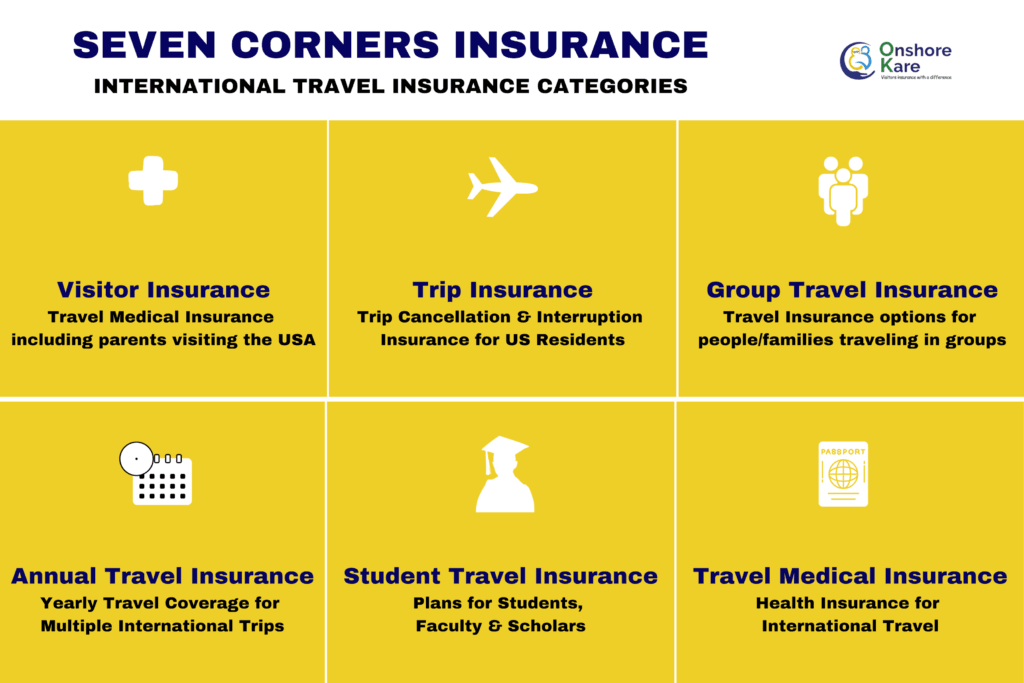

4. Seven Corners

Why It Stands Out: Seven Corners offers robust international and domestic travel coverage, making it a favorite for families and older travelers.

- Key Features:

- Medical coverage up to $1 million (Liaison Travel Plus plan).

- Pre-existing condition waiver available.

- Family-friendly plans.

- Trip delay and baggage loss coverage.

Best For: Families and senior travelers.

5. AXA Assistance USA

Why It Stands Out: AXA Assistance is known for its excellent customer service and reliable coverage.

- Key Features:

- Coverage for medical emergencies and evacuations.

- 24/7 global travel assistance.

- CFAR add-on available.

- Baggage and personal effects coverage.

Best For: Travelers prioritizing customer service and peace of mind.

How to Choose the Right Travel Insurance Plan

When selecting a travel insurance plan, consider the following factors:

- Trip Destination: Ensure the plan covers your destination, especially if traveling internationally.

- Coverage Needs: Determine if you need basic coverage or additional options like adventure sports or CFAR.

- Pre-existing Conditions: Look for plans with a waiver if you have existing health conditions.

- Budget: Compare costs and benefits to find the best value.

- Policy Reviews: Read customer reviews for insights into claims processing and support.

Final Thoughts

Travel insurance provides peace of mind, ensuring that unexpected events don’t ruin your trip. Whether you’re a frequent flyer, an adventurer, or a family vacationer, there’s a plan tailored to your needs. Evaluate your requirements, compare plans, and choose wisely to enjoy stress-free travels in 2024.

Expert Suggestion: Insurance expert Michael Lee states, “AXA Assistance USA’s 24/7 support ensures travelers have help at any time, making it ideal for those seeking peace of mind during their trips.”

How to Choose the Right Travel Insurance Plan

When selecting a travel insurance plan, consider the following factors:

Policy Reviews: Read customer reviews for insights into claims processing and support.

Sources:

Trip Destination: Ensure the plan covers your destination, especially if traveling internationally.

Coverage Needs: Determine if you need basic coverage or additional options like adventure sports or CFAR.

Pre-existing Conditions: Look for plans with a waiver if you have existing health conditions.

Budget: Compare costs and benefits to find the best value.